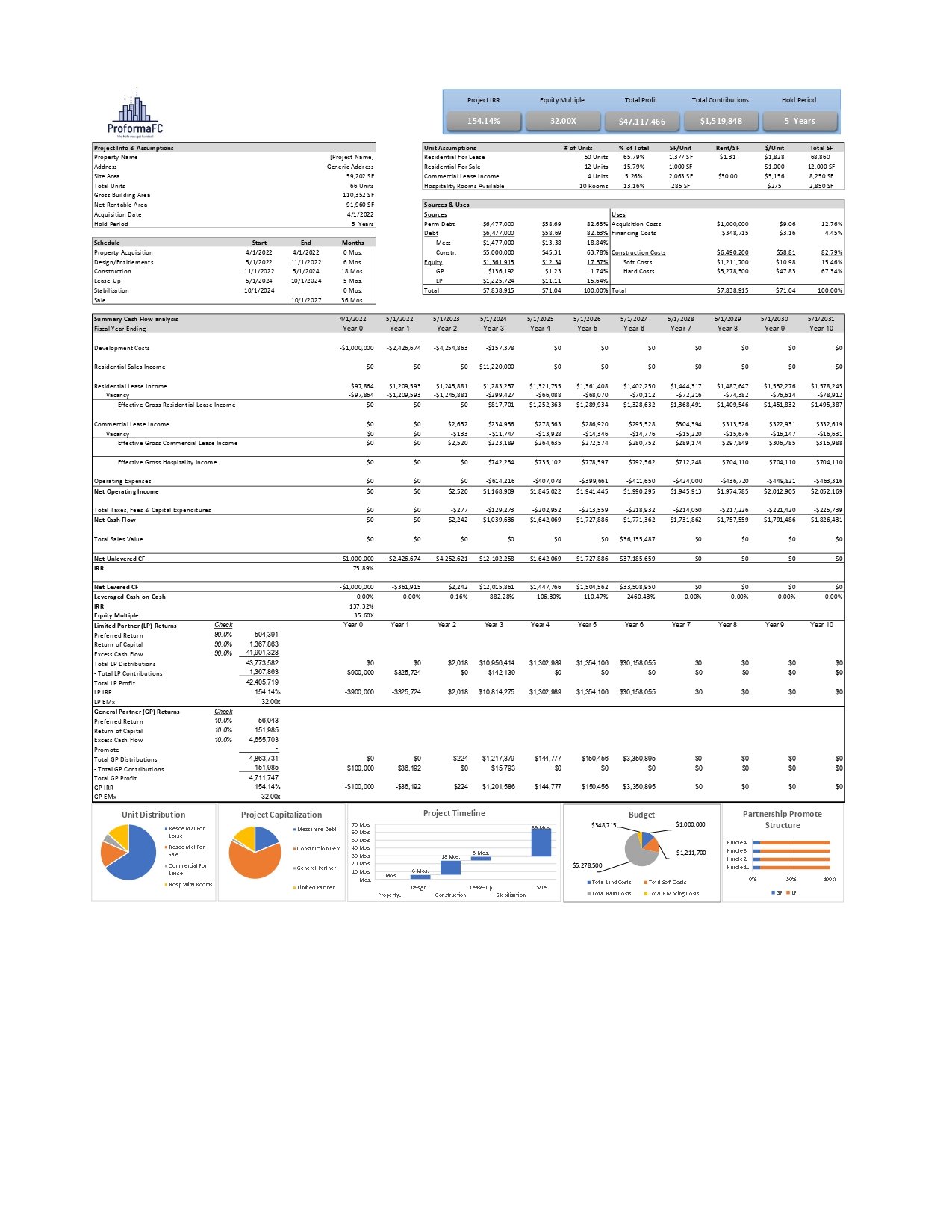

Multifamily / Commercial / Hospitality / Residential - Development Proforma

Welcome to ProformaFC’s Advanced Mixed Use Development Proforma. This model contains multifamily, commercial, hospitality and residential asset classes all in one easy to run ground-up proforma.

Welcome to ProformaFC’s Advanced Mixed Use Development Proforma. This model contains multifamily, commercial, hospitality and residential asset classes all in one easy to run ground-up proforma.

Welcome to ProformaFC’s Advanced Mixed Use Development Proforma. This model contains multifamily, commercial, hospitality and residential asset classes all in one easy to run ground-up proforma.

Explore the potential of our prebuilt advanced mixed use development proforma, designed to provide investors with a comprehensive financial analysis of prime real estate opportunities. Whether you're a seasoned investor or a newcomer to the real estate market, our mixed use development proforma will empower you with the insights needed to make informed decisions and maximize returns.

Key Features:

Detailed Financial Analysis:

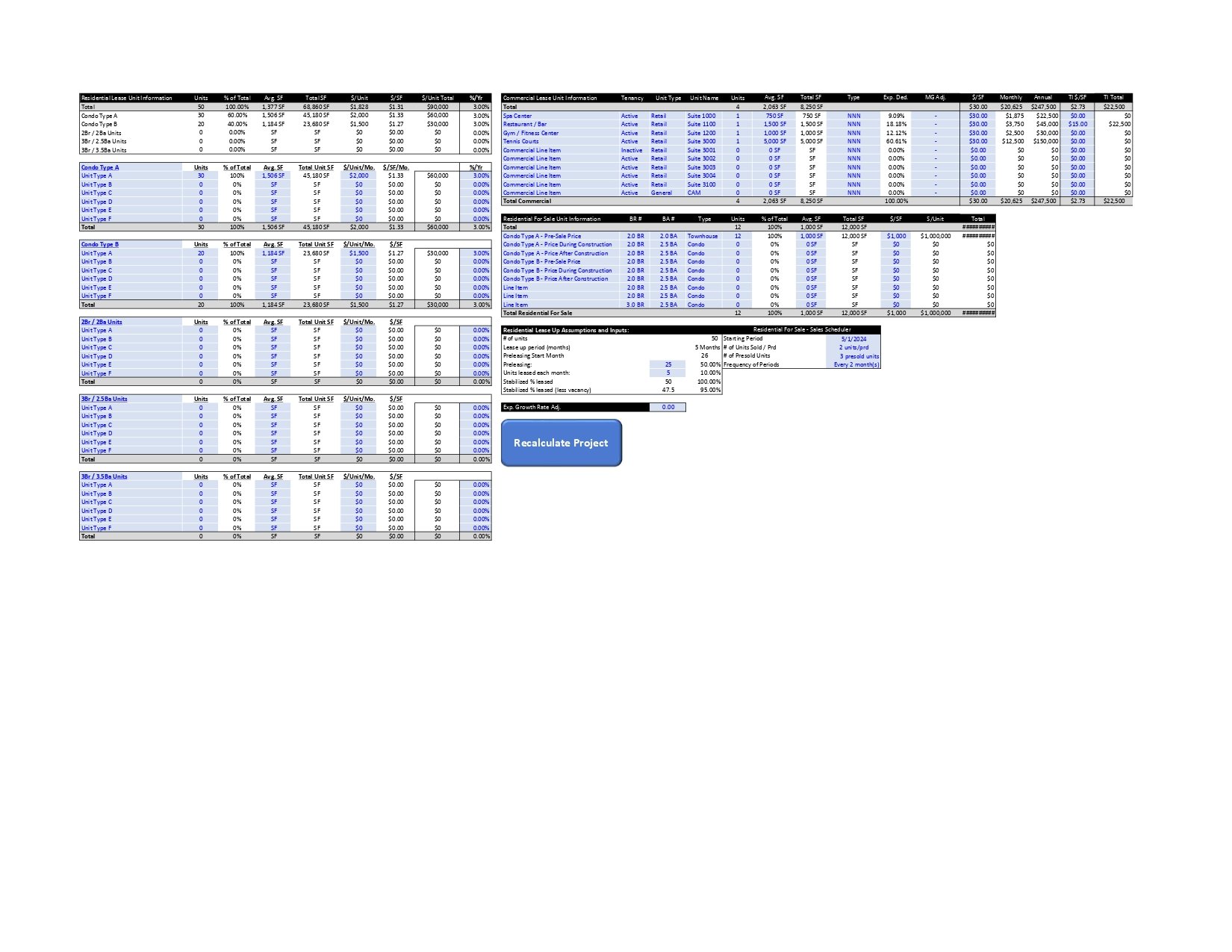

Various multifamily unit type input options to allow for categorizing of units based on type, location within the building, size, rental rate, etc.

Various ancillary income options such as pet rents and fees, application fees, vending income, etc.

Various commercial unit type input options to allow for categorizing of units based on type (Office, Retail, Industrial), lease type (NNN, FSG, MG), rental rate, etc.

Tenant improvement inputs per leasable space.

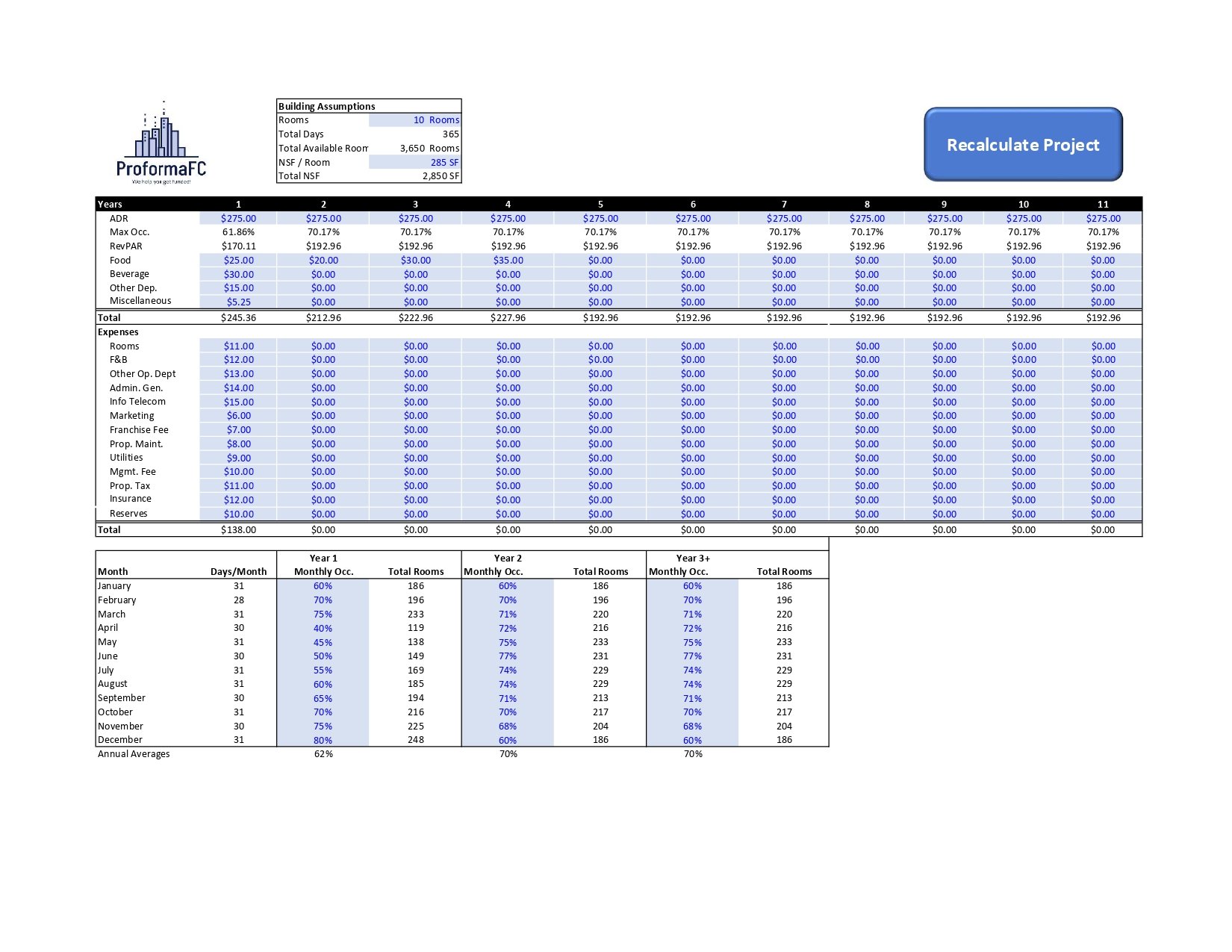

Hospitality room count and average size inputs with ADR and RevPAR based income calculations.

Various ancillary income options such as food and beverage sales, item rentals, vending income, etc.

Operating expenses calculated on $/Room basis.

Various residential unit type input options to allow for categorizing of units based on type, location within the property, size, sales rate, etc.

Variable sales timing triggers for residential units.

Operating expenses calculated as $/GSF, $/NRSF, $/Unit, $/Month and $/Year for Multifamily and Commercial asset classes.

Budget sections with sub-line items broken into Land, Soft, Hard and Financing costs.

Multiple layers of financing including mezzanine, construction and permanent debt.

3-Tier IRR hurdle-based waterfall including pref., promote and GP catch-up.

Sources & uses including variable timing inputs per budget line item for periods such as design & entitlements and construction.

Sources & uses including variable allocation formats per budget line item such as a bell-curve, straight line or fixed-month disbursal.

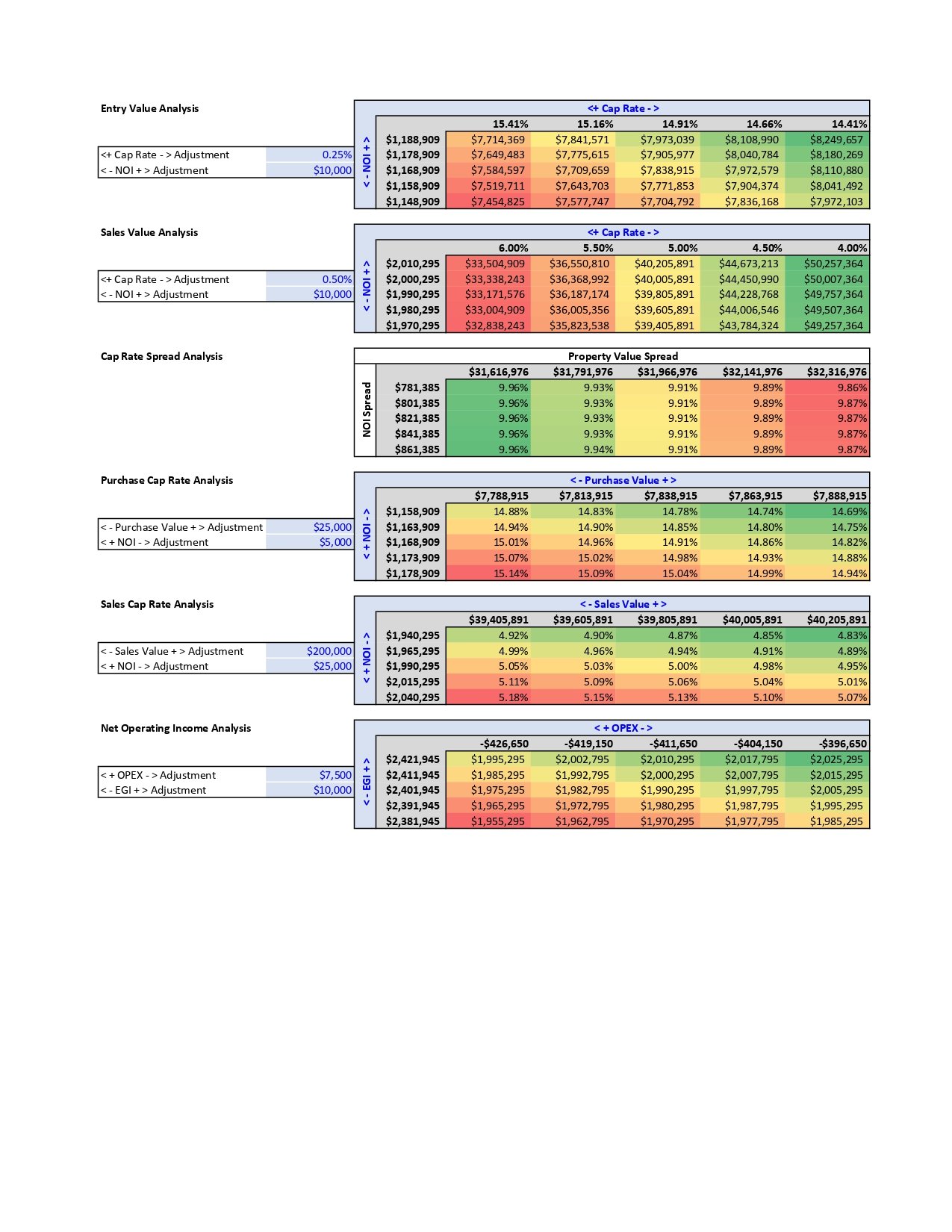

Scenario Planning:

Explore various investment scenarios with sensitivity analysis, helping you anticipate the impact of market fluctuations and make informed decisions.

Investment Returns:

Understand the expected return on investment (ROI) through various metrics such as your projects Internal Rate of Return (IRR) or your equity investor’s various Cash-on-Cash and Equity Multiple returns.

Why Choose Our Proforma:

Expertly Crafted:

Developed for over 10 years, ProformaFC’s models have been expertly built and revised based on client feedback and the ever-changing market conditions.

User-Friendly:

Easy-to-understand format using the blue-cell input convention, makes inputting adjustments to the model a quick simple task.

Customizable:

Tailor the proforma to specific project details and parameters, allowing for a personalized analysis based on your unique investment goals.